We have all answers

Here are answers to frequently asked questions from our clients and partners. For your convenience, questions are collected in groups related to one or another part of our platform

Common questions

General questions regarding the use of the platform, cryptocurrencies and account

Common questions

Common questions

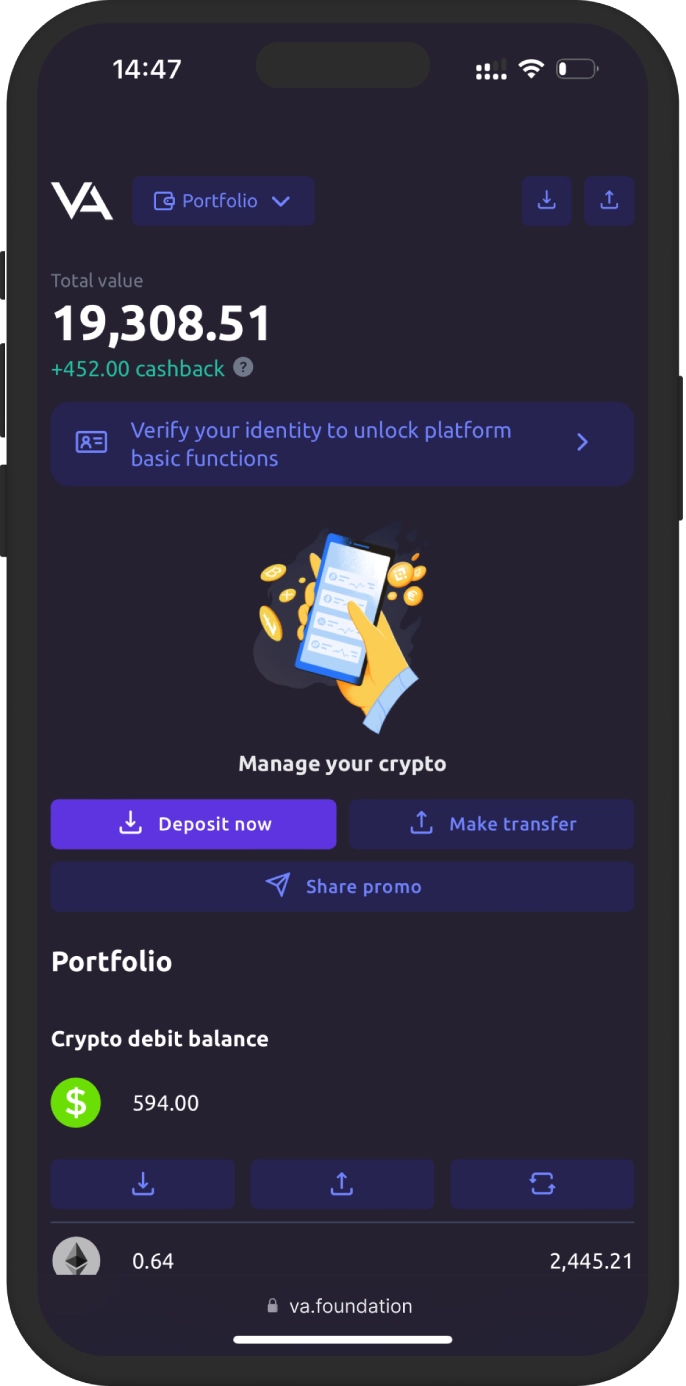

How to top up your account?

You can top up your account in your personal account. Click the “Deposit” button at the top of the page or the replenishment icon opposite the currency in the “Portfolio” section. There will be further instructions in the deposit modal window.

How to withdraw funds from my account?

To withdraw funds, you must submit an application in your personal account. The funds will be credited to the account you specified.

What information do I need to provide when registering?

When registering, you need to provide a login, email and password. Additionally, in your Profile you can indicate your last name, first name, patronymic and other data that must be filled in to successfully complete verification.

What levels of verification are there?

There are three levels of verification:

Level 1 - confirmation of email address

Level 2 - confirmation of identity document

Level 3 - confirmation of tax document and selfie

How long does the withdrawal process take?

The withdrawal process usually takes up to 48 hours.

In some cases*, processing times may be increased due to additional checks or network delays.

* weekends and holidays:

- Christmas – December 24 – January 3

What should I do if I forgot my password?

If you have forgotten your password, click on the Authorization page at the bottom and click on the link "Forgot your password? Reset." You will receive an email with further instructions to restore access to your account.

What is a debit, credit, deposit and cashback balance?

The debit balance contains your funds, including replenishments, deposit payments and loyalty program accruals.

The credit balance contains issued loan funds and write-offs on loans.

The collateral balance contains assets that are pledged as collateral for a loan and are not available until the loan is repaid.

Cashback balance contains accruals for cashback vouchers. Funds on this balance are available only for investment.

Yield account

Questions regarding the operation of an income account and the conditions for accruing profit

Yield account

How to open an yield account with the VA Foundation?

To open an income account, you need to register on our website and pass level 1 verification.

What is the minimum amount I can invest?

The minimum deposit amount is 250 USDT.

What period can I choose for open a deposit?

The deposit period can be from 15 to 90 days.

How is interest calculated?

Interest is accrued daily at 00:00 GMT-07:00 (California, USA time) on the debit balance.

Can I withdraw my funds from the deposit early?

Early withdrawal of funds from the deposit is not provided. According to the terms of the contract, you can receive your funds in full at the end of the deposit period.

What currency can be used for deposits?

Deposits are accepted only in Tether (USDT).

Can I open several deposits at the same time?

Yes, you can open multiple deposits at the same time, provided each of them meets the minimum amount and other requirements.

What happens to accrued interest if the deposit term has not yet expired?

Accrued interest is credited to your debit balance daily and is available for withdrawal or opening a new deposit.

Yield account

Cryptocurrency and prices

Questions about cryptocurrencies, coin pricing and their impact on the market

Cryptocurrency and prices

Cryptocurrency and prices

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security.

How to buy cryptocurrency?

Cryptocurrency can be purchased through cryptocurrency exchanges, specialized exchangers or P2P platforms.

What are the advantages of cryptocurrencies?

Cryptocurrencies offer decentralization, fast transactions and low fees, as well as the possibility of inflation protection.

How to store cryptocurrency?

Cryptocurrency can be stored in hardware wallets, online wallets, or exchanges.

What is blockchain?

Blockchain is a distributed ledger that records all transactions on a network. It ensures data security and transparency through the use of cryptographic algorithms.

How are cryptocurrencies mined?

Mining is the process of validating and adding new transactions to the blockchain. Miners use the computing power of their devices to solve complex mathematical problems and receive rewards in the form of cryptocurrency.

What are stablecoins?

Stablecoins are cryptocurrencies pegged to the value of real assets, such as the US dollar, euro or gold. They are designed to reduce volatility and ensure price stability.

What is the difference between cold and hot storage of cryptocurrencies?

Cold storage is the storage of cryptocurrencies in offline wallets that are not connected to the Internet, which ensures maximum security.

Hot storage is storage in online wallets that are connected to the Internet, providing easy access but less security.

How to choose a cryptocurrency exchange?

When choosing a cryptocurrency exchange, consider factors such as security, fees, supported cryptocurrencies, ease of use, and the exchange's reputation among users.

Crypto loans

Questions regarding cryptocurrency loans and their working conditions

Crypto loans

How to get a crypto loan from the VA Foundation?

To receive a crypto loan, you need to register, go through level 3 verification and select the necessary loan parameters in your personal account.

What cryptocurrencies are accepted as collateral?

BTC, ETH, BCH, DOGE, TRX and LTC are accepted as collateral.

What is the minimum loan amount?

The minimum loan amount is 250 USDT.

What is loan liquidation?

Loan liquidation is the sale of a collateral asset at a market price in order to repay the loan when the liquidation threshold is reached.

What are the conditions for liquidating a loan?

Liquidation of a loan occurs if the value of the collateral asset decreases below the liquidation threshold.

Liquidation threshold is a specified percentage of the loan amount that must be secured by the collateral asset at the market rate in USDT. The liquidation threshold ranges from 105% to 110% of the loan amount, depending on the parameters selected.

What happens if I cannot repay the loan on time?

If the loan cannot be repaid on time, your collateral asset will be sold to repay the loan.

What are the collateral requirements for obtaining a loan?

The minimum collateral ranges from 115% to 140% of the loan amount, depending on the loan terms. There is no maximum threshold.

How often does interest accrue on a loan?

Interest on the loan is calculated daily and is automatically debited from the loan balance.

Can I change the terms of the loan after receiving it?

The terms of the loan cannot be changed after it has been received. However, you can repay the loan early without penalty.

How does loan liquidation work?

Loan liquidation occurs automatically if the value of the collateral asset falls below the liquidation threshold. The collateral will be sold at market price to repay the loan.

Crypto loans

Loyalty program

Questions regarding the loyalty program and affiliate payments

Loyalty program

Loyalty program

How does the loyalty program work?

The loyalty program allows you to receive a portion of commissions from profits on deposits and payments on loans from new clients who indicated your affiliate promotional code when registering. You can receive a promo code or share an affiliate link in your personal account.

What is the amount of affiliate payments?

Affiliate payments are 10% of profits on deposits and payments on partner loans.

How are affiliate payments calculated?

Affiliate payments are calculated after payments on deposits and write-offs on loans. Your share of commissions is credited to your debit balance and is available for payment of fund services or withdrawals.

Where can I find my affiliate link?

Registration of new partners occurs using an affiliate promotional code, which is displayed in your personal account. However, you can also copy the affiliate link and share it with friends, family or acquaintances. In this case, your affiliate promo code will be filled in automatically.

Are there any restrictions on the number of partners I can attract?

No, there are no restrictions on the number of partners. You can attract an unlimited number of new clients using your promo code or affiliate link.

How long does my affiliate link last?

Your affiliate link, which includes your promo code, is permanent and does not change over time. New clients who register using your link will always be your partners.

Cashback service

Questions regarding the VA Foundation cashback service and voucher activation

Cashback service

How to get a cashback voucher?

A cashback voucher is generated automatically when you make a new deposit for 5% of the deposit amount. If you have vouchers, you can see them in the Portfolio section.

How to use a cashback voucher?

The voucher can be activated in your personal account. To do this, click the “+” icon next to your cashback balance and enter the voucher code. The nominal amount will go to the cashback balance.

The voucher can be activated by any customer other than the voucher owner.

How long is a cashback voucher valid?

The voucher is valid until the end of its validity period, which is usually the end date of the deposit.

Can I redeem my own voucher?

No, the voucher can be activated by any customer other than the owner. You can share your voucher code with your friends, family or acquaintances who are VA Foundation clients.

How can I find out how much cashback I have accumulated?

You can check your current cashback balance (and other balances) in your personal account in the "Portfolio" section.

Is there a limit to the number of vouchers I can redeem?

No, there is no limit on the number of vouchers you can activate. You can redeem any number of vouchers received from other users.

Can I transfer cashback to a debit balance or another wallet?

No, however, cash back can be used in full to invest on the VA Foundation platform. The deposit amount, including cashback, will be returned and available for transfer at the end of the deposit period.

How is the cashback voucher amount calculated when opening a new deposit?

A voucher is generated when opening a new deposit for any amount. The nominal amount of the cashback voucher is 5% of the deposit amount (rounded to the nearest whole number).