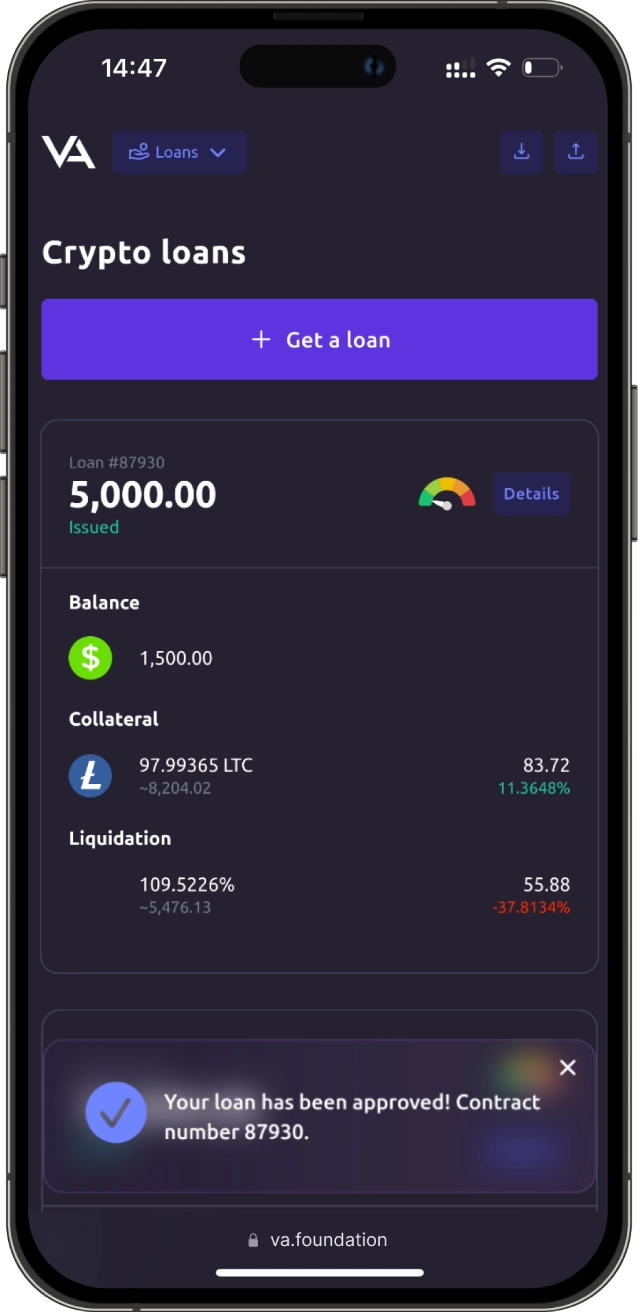

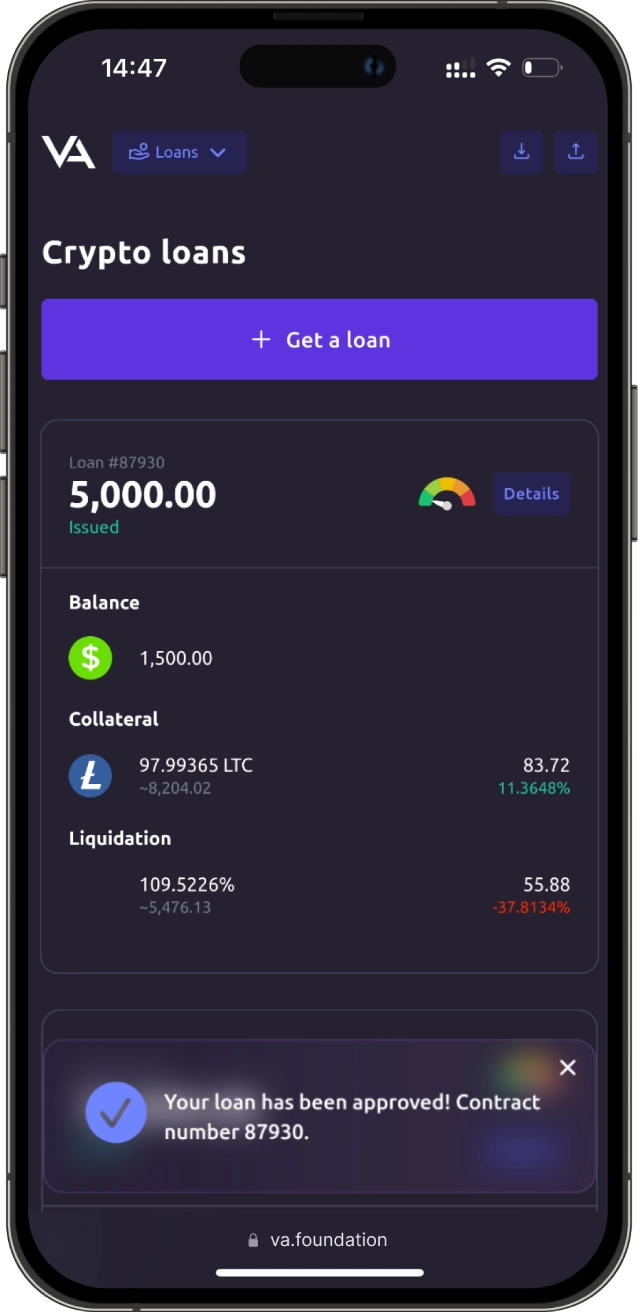

Obtain a loan backed by the most popular cryptocurrencies

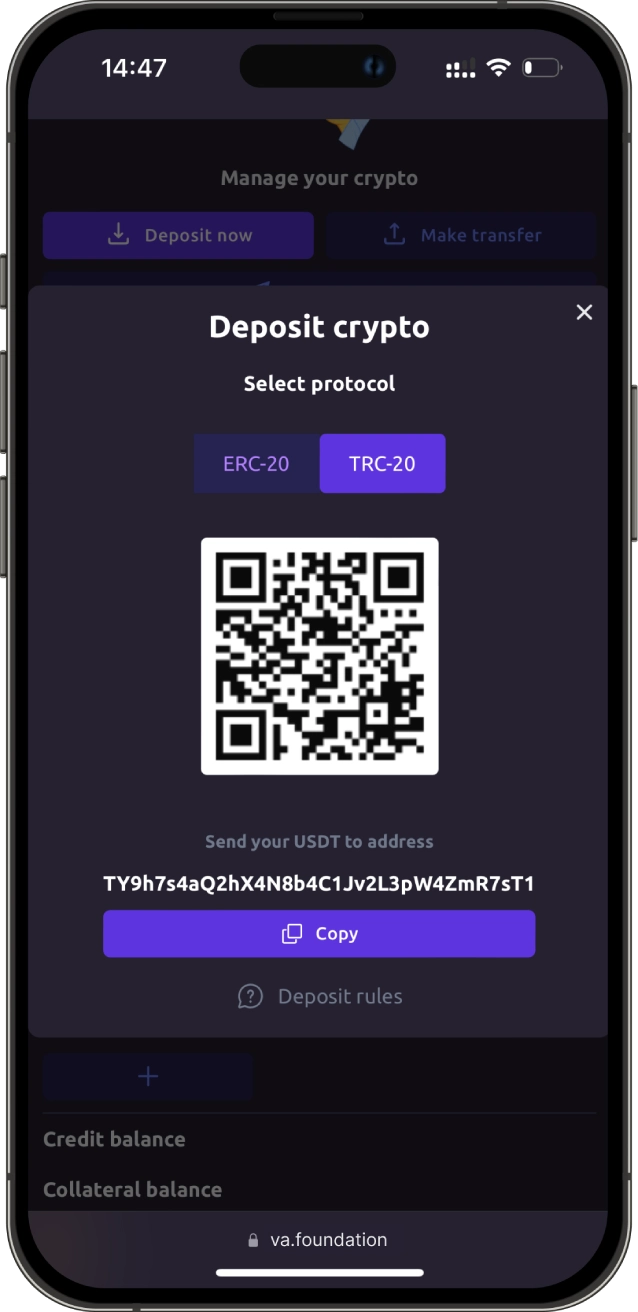

Take advantage of an instant crypto loan. Receive funds in Tether (USDT) and withdraw them at your convenience - to your wallet or another exchange.

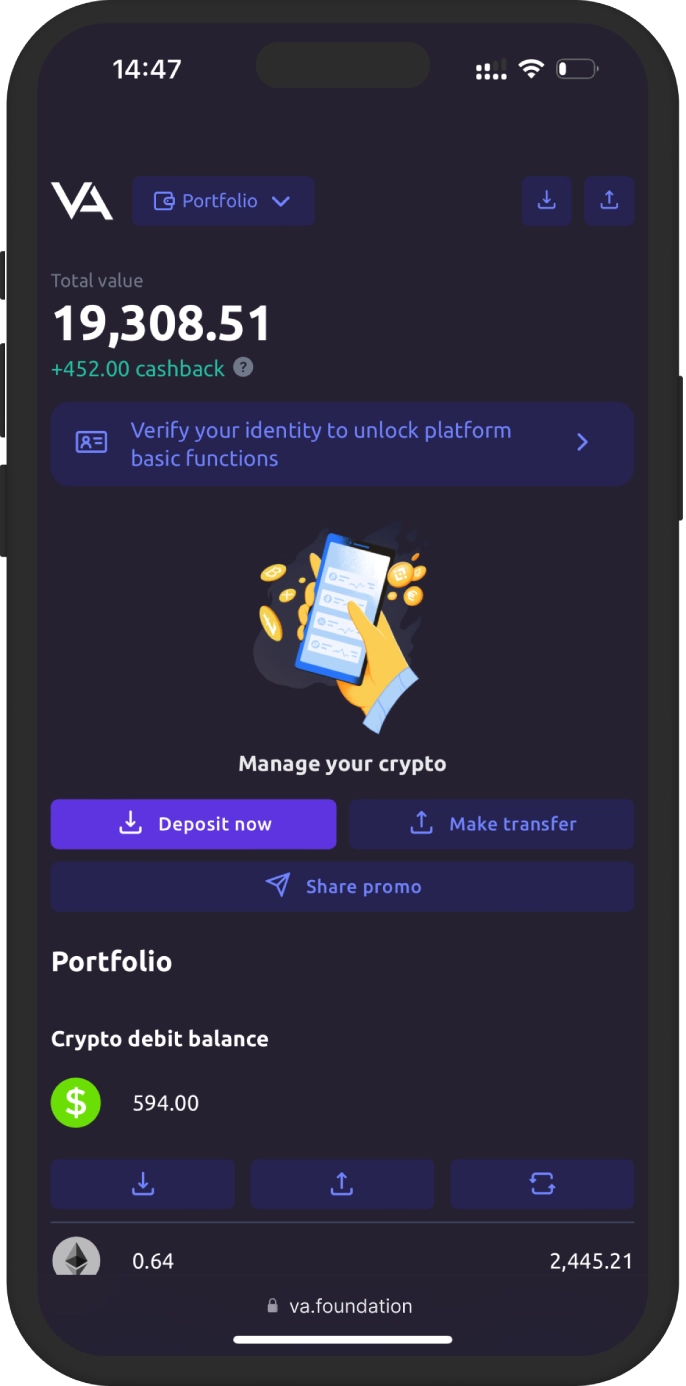

Get a Loan Using Your Crypto

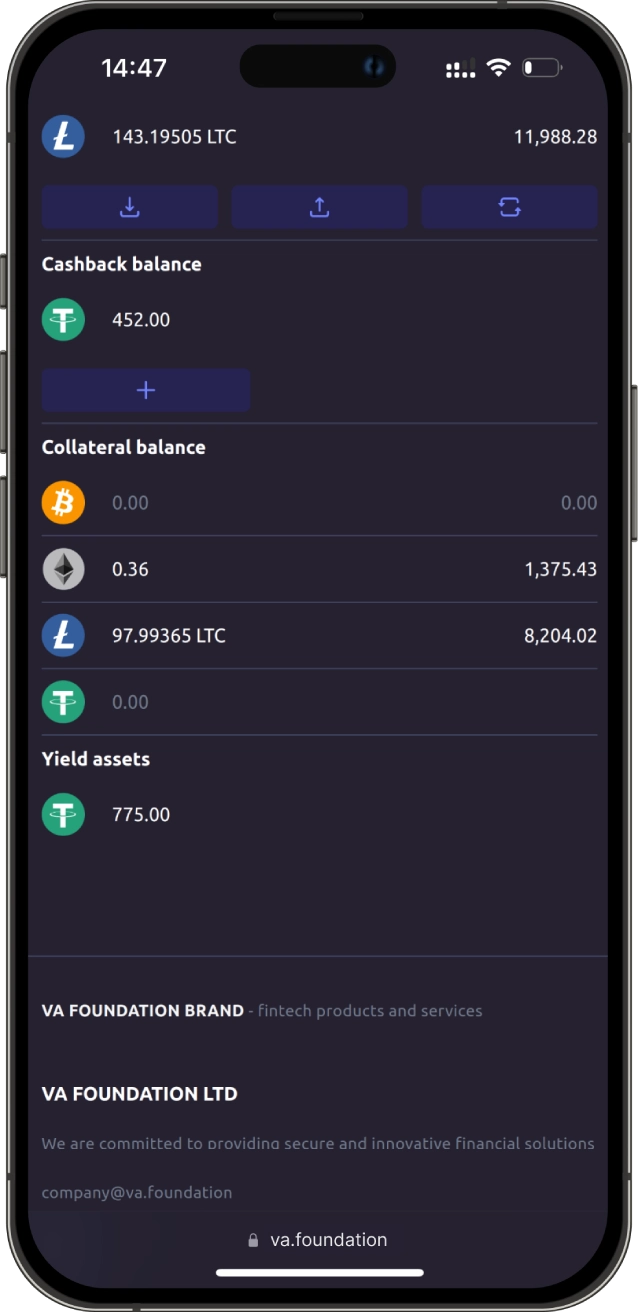

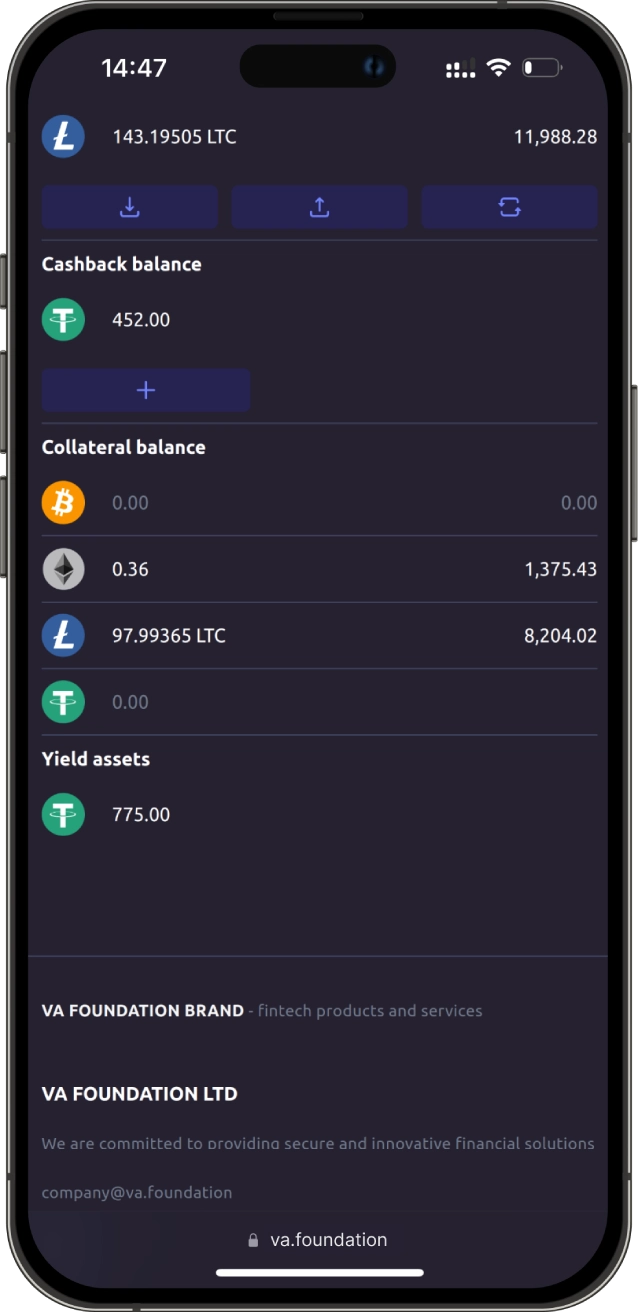

Collateral Options

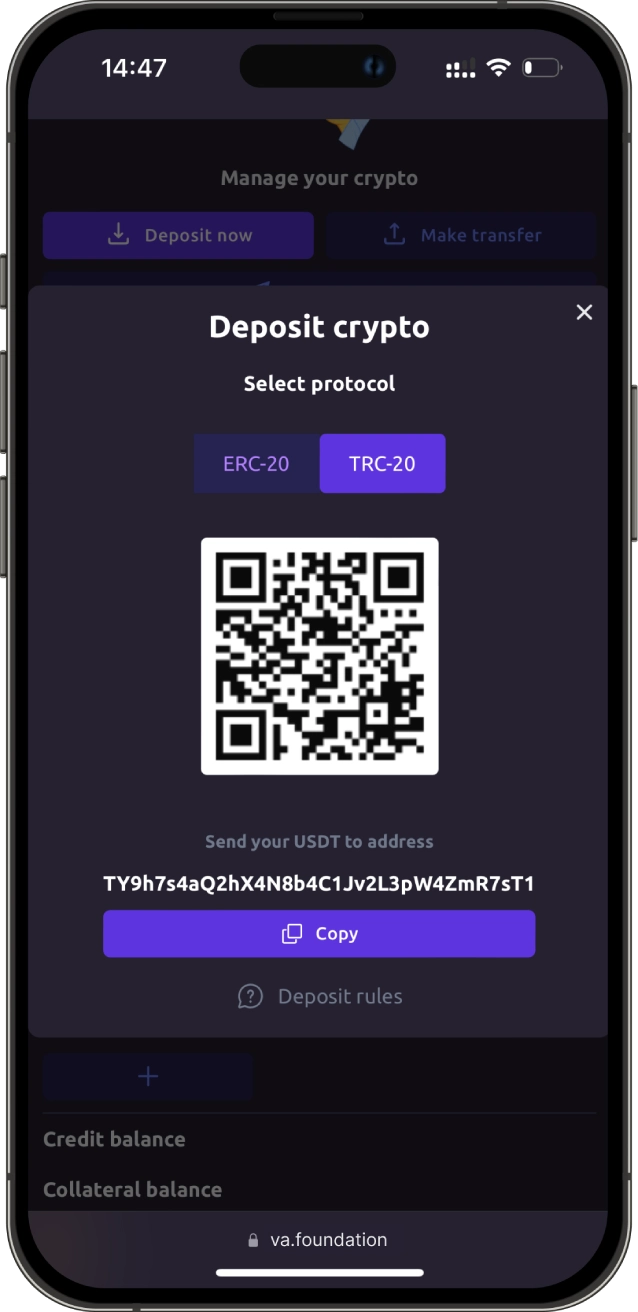

Deposit Your Crypto

Immediate Loan Approval

Access Your Collateral Anytime

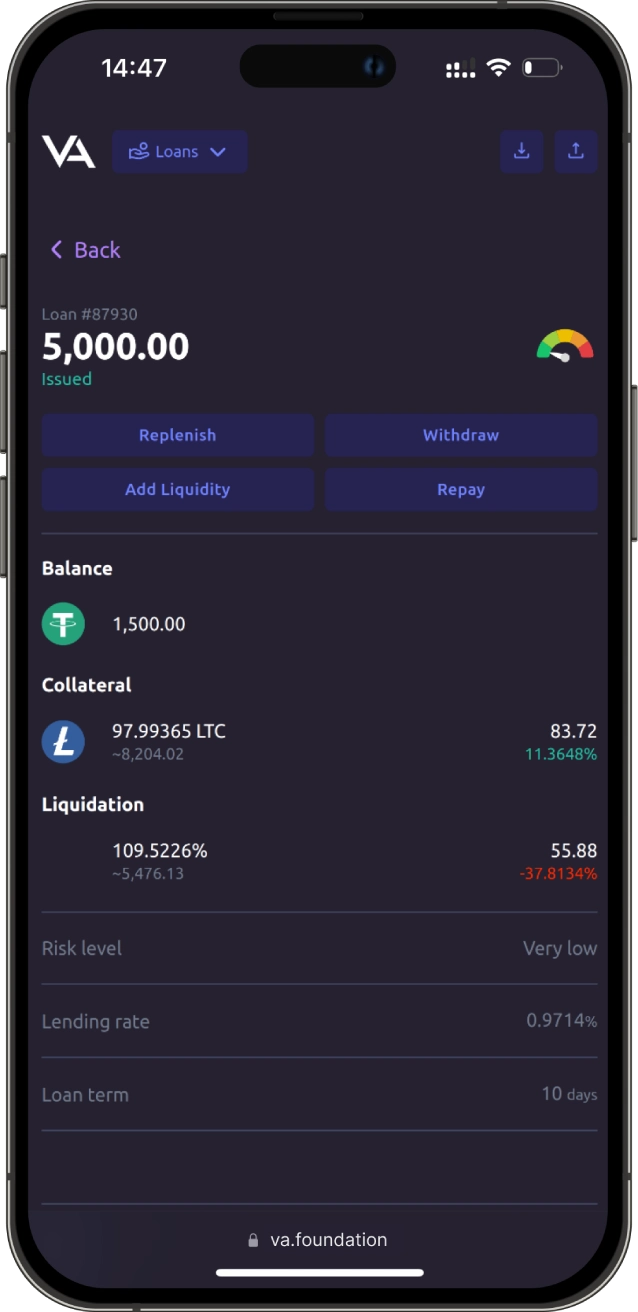

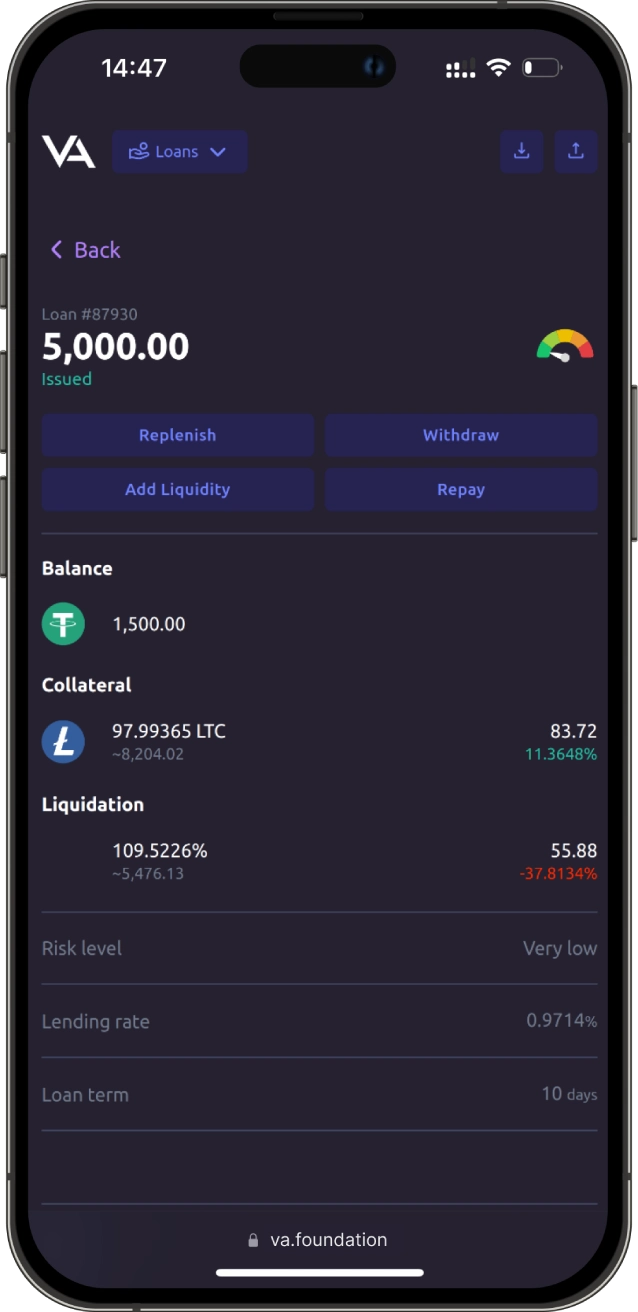

Sophisticated Loan Management Tools

We have all the answers

We have all the answers

How to get a crypto loan from the VA Foundation?

To receive a crypto loan, you need to register, go through level 3 verification and select the necessary loan parameters in your personal account.

What cryptocurrencies are accepted as collateral?

BTC, ETH, BCH, DOGE, TRX and LTC are accepted as collateral.

What is the minimum loan amount?

The minimum loan amount is 250 USDT.

What is loan liquidation?

Loan liquidation is the sale of a collateral asset at a market price in order to repay the loan when the liquidation threshold is reached.

What are the conditions for liquidating a loan?

Liquidation of a loan occurs if the value of the collateral asset decreases below the liquidation threshold.

Liquidation threshold is a specified percentage of the loan amount that must be secured by the collateral asset at the market rate in USDT. The liquidation threshold ranges from 105% to 110% of the loan amount, depending on the parameters selected.

What happens if I cannot repay the loan on time?

If the loan cannot be repaid on time, your collateral asset will be sold to repay the loan.

What are the collateral requirements for obtaining a loan?

The minimum collateral ranges from 115% to 140% of the loan amount, depending on the loan terms. There is no maximum threshold.

How often does interest accrue on a loan?

Interest on the loan is calculated daily and is automatically debited from the loan balance.

Can I change the terms of the loan after receiving it?

The terms of the loan cannot be changed after it has been received. However, you can repay the loan early without penalty.

How does loan liquidation work?

Loan liquidation occurs automatically if the value of the collateral asset falls below the liquidation threshold. The collateral will be sold at market price to repay the loan.