Home / Lending

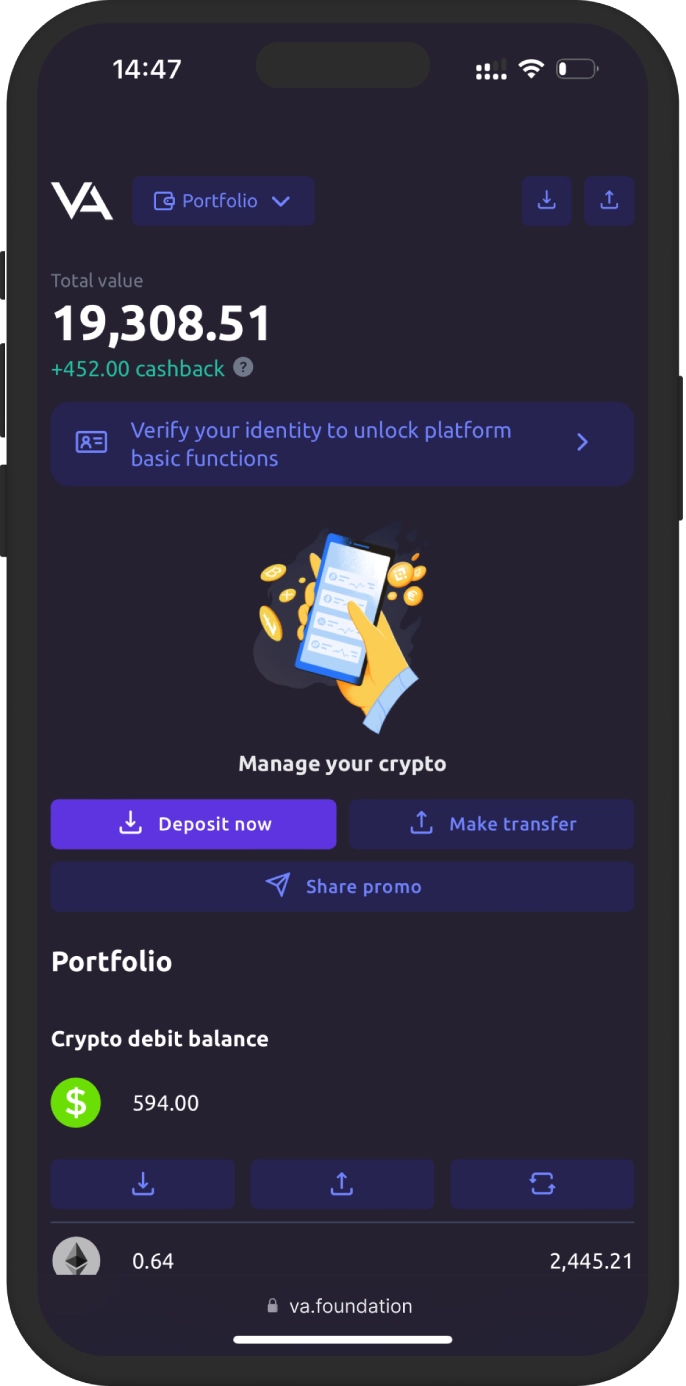

Crypto Lending: Get liquidity while preserving your assets.

Why is this necessary?

Crypto enthusiasts are often encouraged to “HOLD” their assets by storing them in a wallet until the price of the chosen currency rises. But just as you wouldn't want to keep your money in a bank with a low interest rate, the question often arises: how can you make sure your investment in digital currency grows?

This is where cryptocurrency lending comes in. This not only allows savers to earn interest on their Bitcoin holdings, but also gives borrowers the opportunity to unlock the value of their digital assets by using them as collateral for a loan.

Implementation of short-term goals

When investing, one of the biggest challenges can be cash flow - and nothing is worse than withdrawing funds tied up in assets to cover short-term costs and lack of liquidity.

A simple solution

Crypto lending can come to the rescue. You use your assets as collateral to obtain a loan. This will require pledging slightly more assets than the loan amount due to the volatility of the cryptocurrency. After repayment of the loan with interest, the deposit is returned in full.

Minimal risks

The collateral amount will only be at risk if the terms of the loan are not met or if the value of the cryptocurrency used as collateral falls below the liquidation threshold.

Open an account Advantages

crypto lending

Availability

Crypto loans do not require a credit score assessment, making lending accessible to people without an established financial history or without a bank account. This is especially beneficial for self-employed workers who have unstable income and find it difficult to meet the requirements of traditional banks.

Flexible terms

Payments on crypto loans can be more flexible, allowing the loan to be tailored to the individual financial needs of the borrower. This is especially important for people with variable income who may have temporary financial difficulties.

Asset liquidity

Obtaining a crypto loan allows you to make assets liquid without the need to carry out taxable transactions related to the sale of cryptocurrency. Borrowers can use cryptocurrency assets as collateral without losing their potential value in the market.

Approval speed

Cryptocurrency loans can be processed almost instantly, unlike traditional financial institutions where loan confirmation can take several days. This allows borrowers to receive the necessary funds quickly, which is especially important in situations of urgent financial assistance.